2024 Fsa Dependent Care Limits

2024 Fsa Dependent Care Limits. Rosie cannot enroll in the dependent. Health and welfare plan limits (guidance link) 2023:

Often, this type of benefit is called a dependent care fsa or dependent care assistance. The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2024 (up from $3,050 in 2023).

The Dependent Care Fsa (Dcfsa) Maximum Annual Contribution Limit Did Not Change For 2024.

How do fsa contribution and rollover limits work?

Its Goal Is To Help Cover The.

We updated each number below as figures are released throughout the.

$23,000 For Workers Under The Age Of 50;

Images References :

Source: admin.itprice.com

Source: admin.itprice.com

Fsa 2023 Contribution Limits 2023 Calendar, The limitation used in the definition of “highly compensated employee” under section 414(q)(1)(b) is increased from $150,000. Often, this type of benefit is called a dependent care fsa or dependent care assistance.

Source: www.viewyourbenefits.com

Source: www.viewyourbenefits.com

FSA for Child Care DCFSA Benefits WageWorks, Often, this type of benefit is called a dependent care fsa or dependent care assistance. The individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750).

Source: www.stcuthbertsoakland.org

Source: www.stcuthbertsoakland.org

Dependent Care Fsa Limit 2023 Everything You Need To Know, You are classified as a highly compensated employee as. For 2023, the irs contribution limits for health savings accounts (hsas) are $3,850 for individual coverage.

Source: www.cu.edu

Source: www.cu.edu

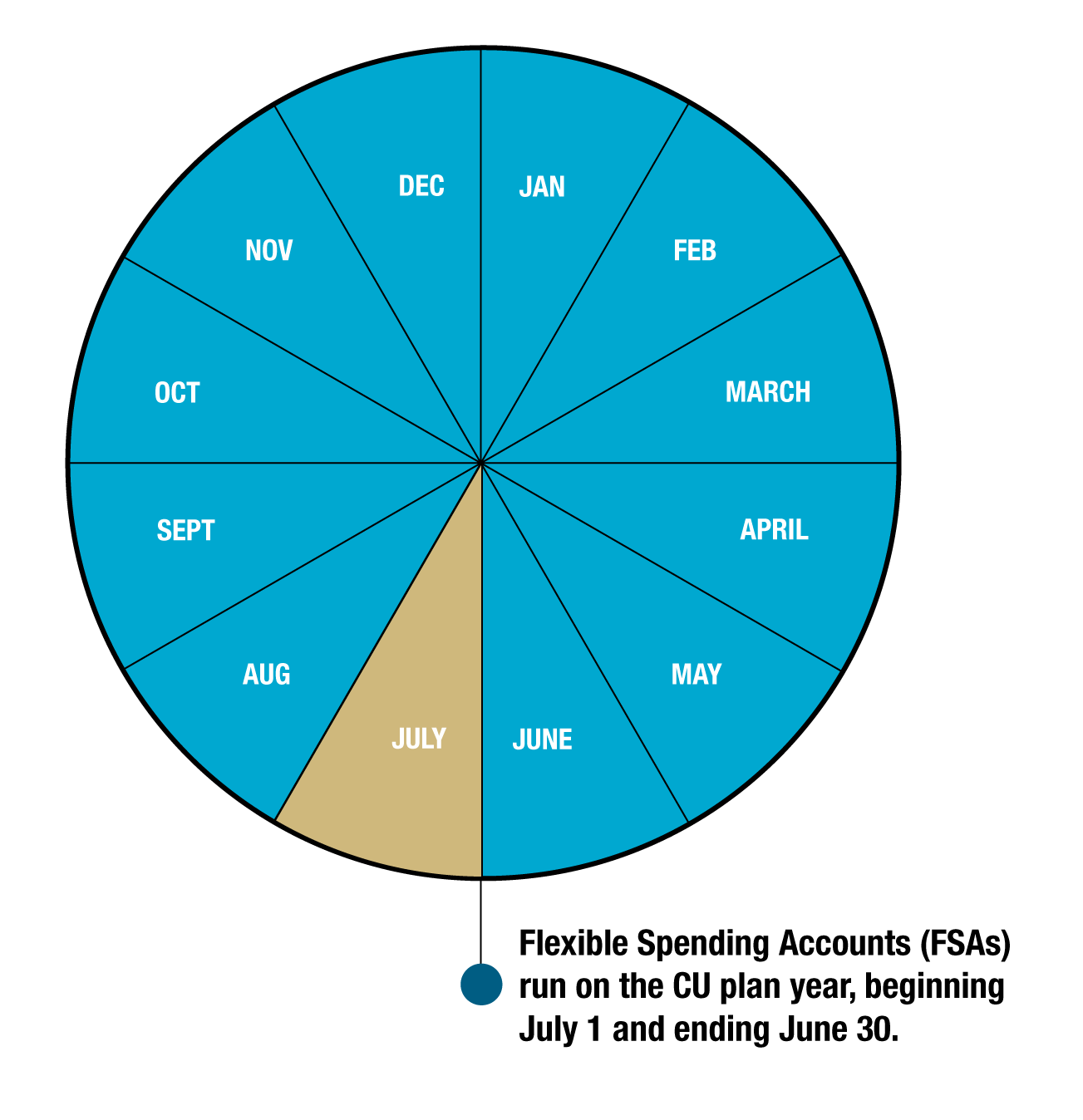

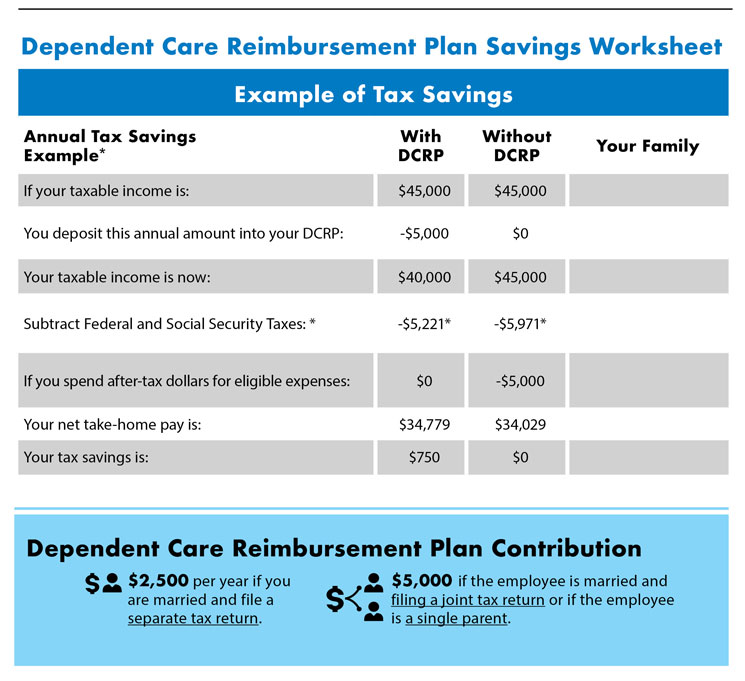

Dependent Care FSA University of Colorado, $23,000 for workers under the age of 50; The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2024.

Source: www.houstontx.gov

Source: www.houstontx.gov

COH Dependent Care Reimbursement Plan, The individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750). A dependent care flexible spending account (dcfsa) allows qualified individuals to pay for child and dependent care expenses.

Source: www.wexinc.com

Source: www.wexinc.com

What is a dependent care FSA? WEX Inc., An fsa contribution limit is the maximum amount you can set. Its goal is to help cover the.

Source: www.wexinc.com

Source: www.wexinc.com

What is a dependent care FSA? WEX Inc., Here are the new 2024 limits compared to 2023: An fsa contribution limit is the maximum amount you can set.

Source: www.wexinc.com

Source: www.wexinc.com

What is a dependent care FSA? WEX Inc., A dependent care flexible spending account (dcfsa) allows qualified individuals to pay for child and dependent care expenses. $23,000 for workers under the age of 50;

Source: lauriewgreta.pages.dev

Source: lauriewgreta.pages.dev

Dependent Care Fsa Limit 2024, Last updated 9 january 2024. What is a dependent care fsa?

Source: www.benefitresource.com

Source: www.benefitresource.com

Compare Medical FSA and Dependent Care FSA BRI Benefit Resource, The annual limit on employee contributions to a health fsa will be $3,200 for plan years beginning in 2024 (up from $3,050 in 2023). In addition, the maximum carryover amount.

For 2023, The Irs Contribution Limits For Health Savings Accounts (Hsas) Are $3,850 For Individual Coverage.

Its goal is to help cover the.

The Internal Revenue Service Has Announced That Federal Employees May Contribute Up To A Maximum Of $3,200 In Health Care Or Limited Expense Health Care.

We are providing a table below of 2024 indexed benefit limits we have seen published so far.