Income Tax New Slab For Ay 2024-24

Income Tax New Slab For Ay 2024-24. For this year, the financial year will be. How to calculate income tax payable under new tax regime.

How to calculate income tax payable under new tax regime. 2) tax rebate under section 87a increased from rs 5.

From Rs 2,50,001 To Rs.

What changes have been made in the new tax regime?

For Those In The Higher Tax Slab And Those Who Can Invest And Take.

Income tax rates for fy.

Rs 90,000 + 20% On Income More Than Rs 12,00,000.

Images References :

Source: savemoremoney.in

Source: savemoremoney.in

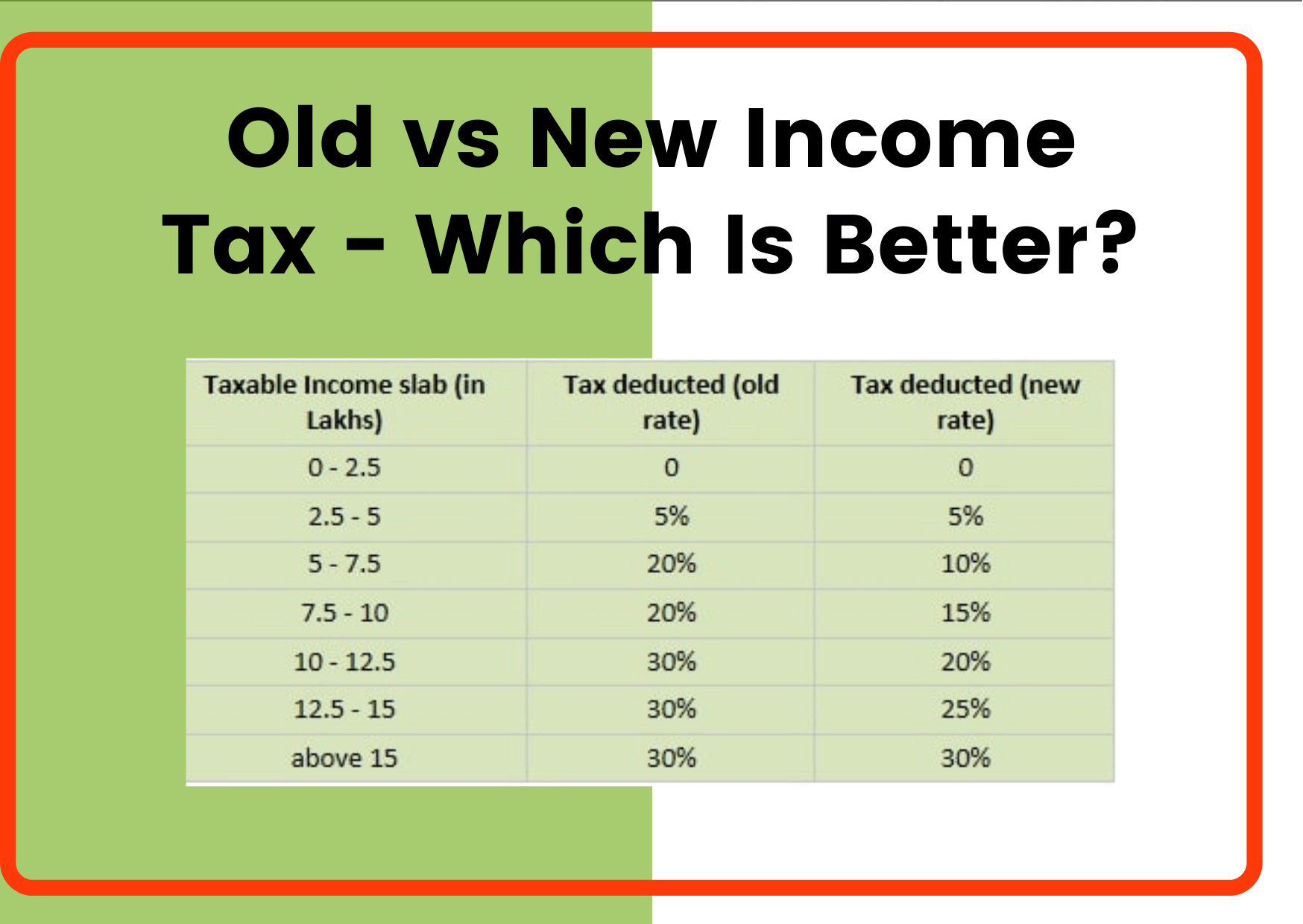

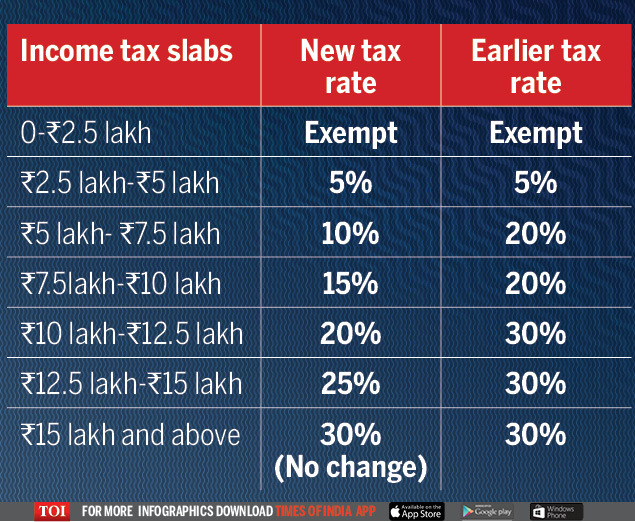

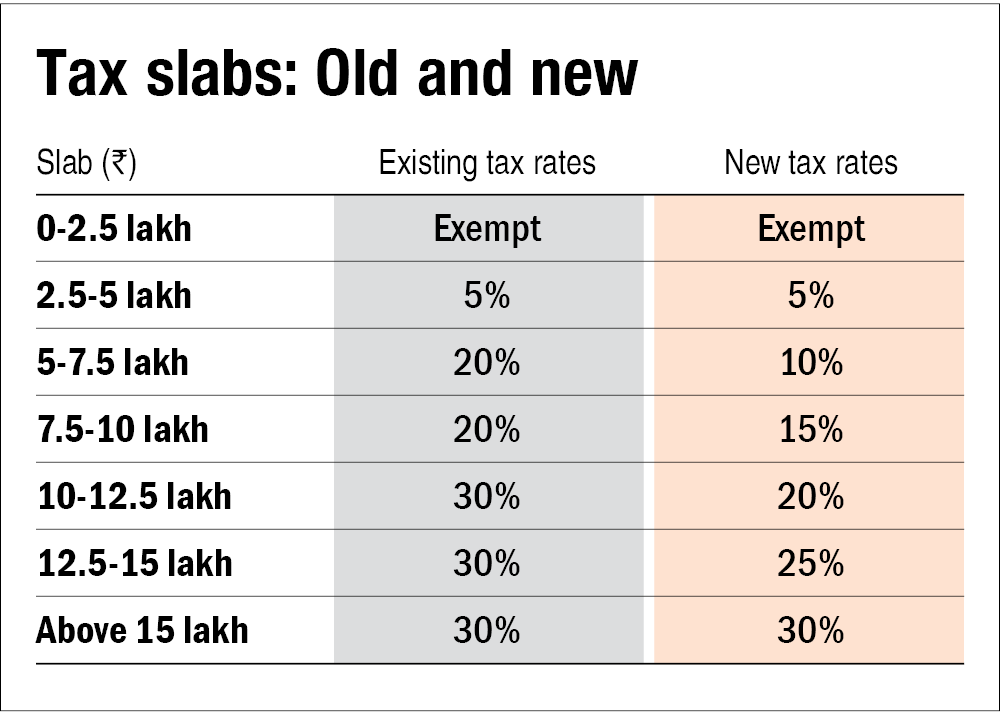

Old Vs New Tax Slabs Who Should Choose What?, In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay). Income tax slabs (in rs) income tax rate.

Source: printableformsfree.com

Source: printableformsfree.com

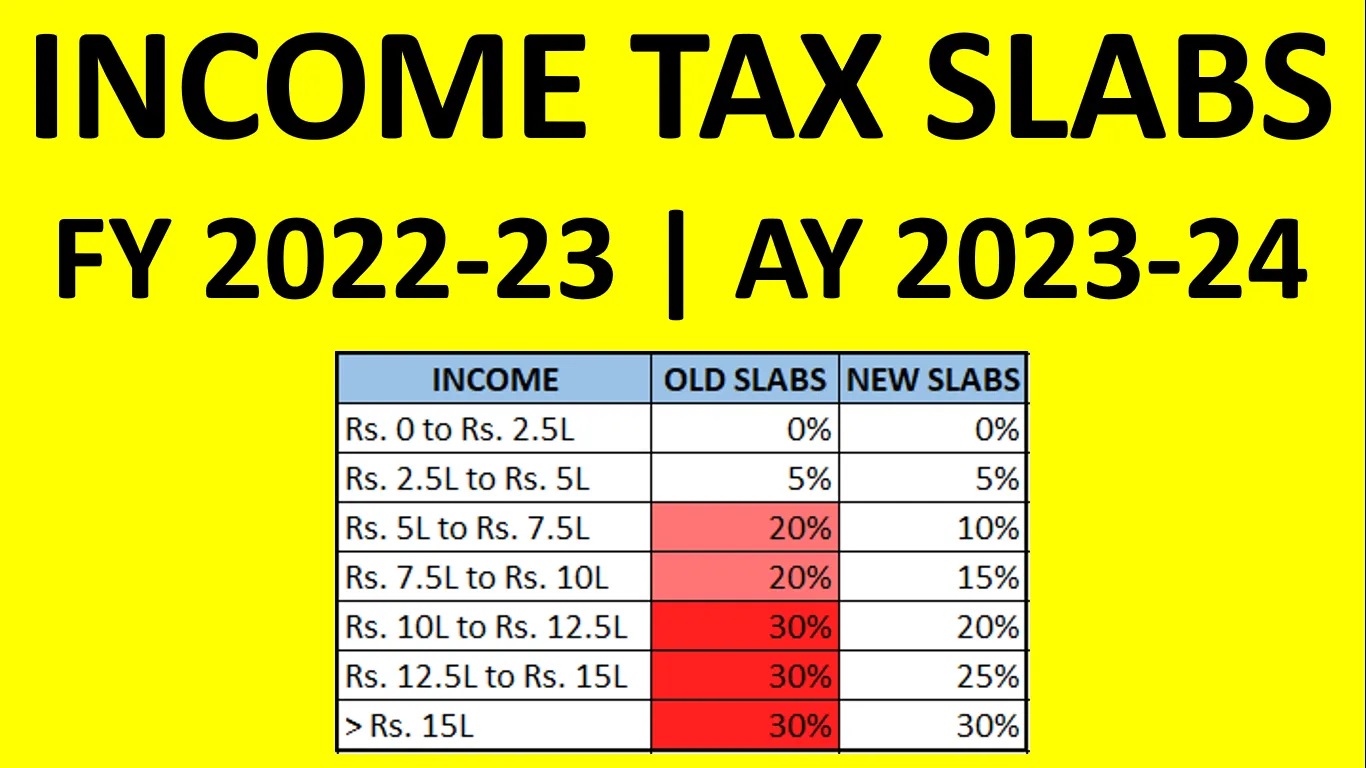

Tax Slab For Ay 2023 24 For Salaried Person New Regime, Budget feb 1, 2023 (income tax slab updates) 1) income tax exemption limit increased from rs 2.5 lakh to rs 3 lakh. For those in the higher tax slab and those who can invest and take.

Source: cleartax.in

Source: cleartax.in

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay). Income tax slabs (in rs) income tax rate.

Source: wall.hoodooclub.cz

Source: wall.hoodooclub.cz

Tax Taxes Concept HooDoo Wallpaper, What changes have been made in the new tax regime? Further the basic exemption limit has been hiked to rs.3 lakh from rs.2.5 earlier under the new income.

Source: career-pavitraindia.blogspot.com

Source: career-pavitraindia.blogspot.com

Tax Rebate में 10 का छूट और 7 Slab रहेगा लागू. मात्र 2.5 लाख, How much tax can be saved if income is rs 10 lakh, rs 50 lakh or rs 1 crore under revamped new tax regime how payment for notice period by salaried. In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).

Source: www.techicy.com

Source: www.techicy.com

Understanding Form 16 and Its Relevance In Tax Slab Techicy, Current income tax slabs under new tax regime. How much tax can be saved if income is rs 10 lakh, rs 50 lakh or rs 1 crore under revamped new tax regime how payment for notice period by salaried.

Tax Slab Rates for AY 202324, Budget feb 1, 2023 (income tax slab updates) 1) income tax exemption limit increased from rs 2.5 lakh to rs 3 lakh. Income tax rates for fy.

Source: api.forbesindia.com

Source: api.forbesindia.com

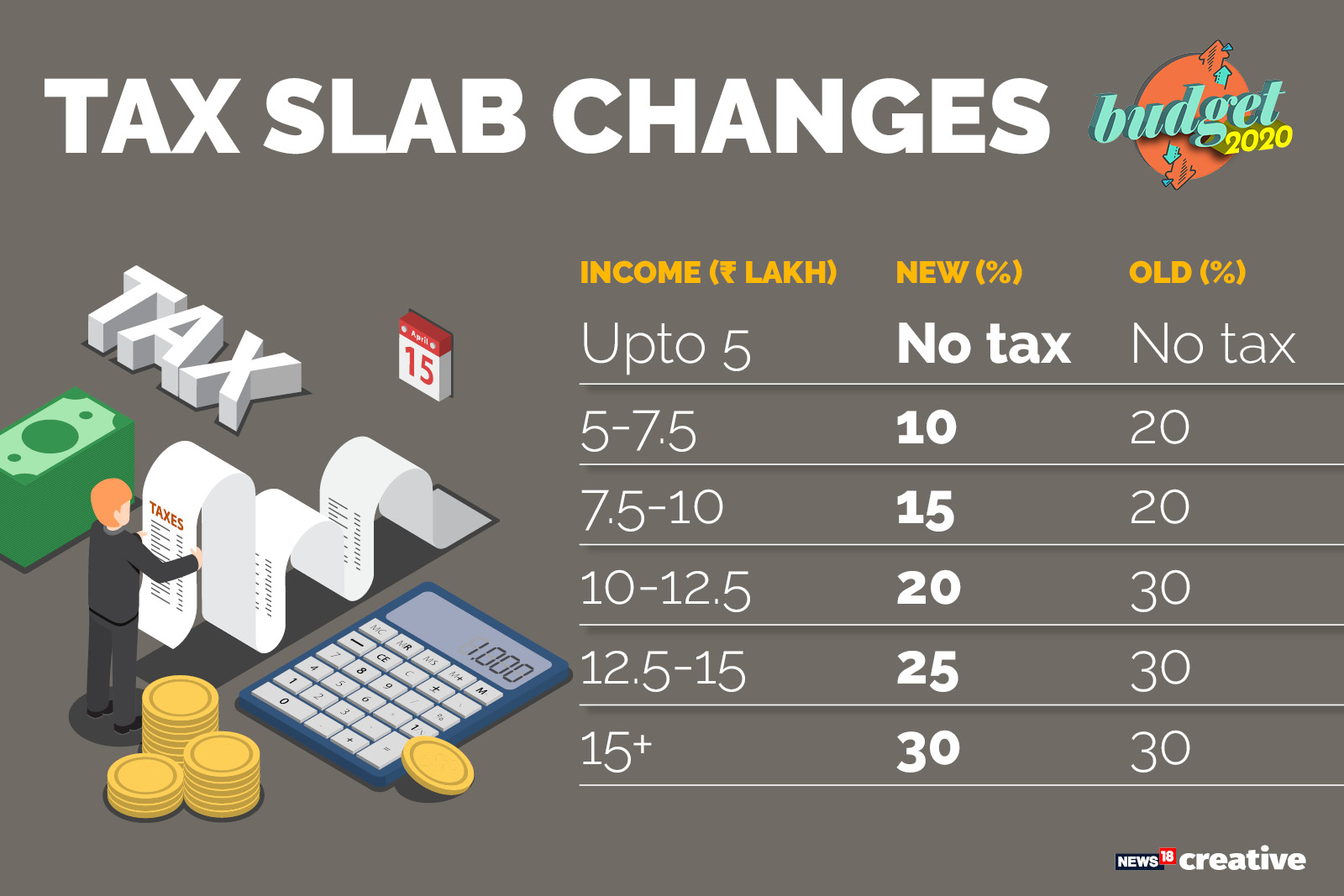

Budget 2020 Will New Tax Slabs Actually Benefit A Taxpayer, Current income tax slabs under new tax regime. Budget feb 1, 2023 (income tax slab updates) 1) income tax exemption limit increased from rs 2.5 lakh to rs 3 lakh.

Source: neswblogs.com

Source: neswblogs.com

Tax Rate For Married Filing Jointly 2022 Latest News Update, What changes have been made in the new tax regime? What are the income tax slabs and income tax rates under the new income tax regime?

Source: ebizfiling.com

Source: ebizfiling.com

Tax Rates Slab for FY 202324 (AY 202425), For this year, the financial year will be. Income tax rates for fy.

From Rs 2,50,001 To Rs.

In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).

Income Tax Slabs (In Rs) Income Tax Rate.

Budget feb 1, 2023 (income tax slab updates) 1) income tax exemption limit increased from rs 2.5 lakh to rs 3 lakh.